Table of Contents

- Advanced Micro Devices Stock Forecast – AMD Technical Analysis

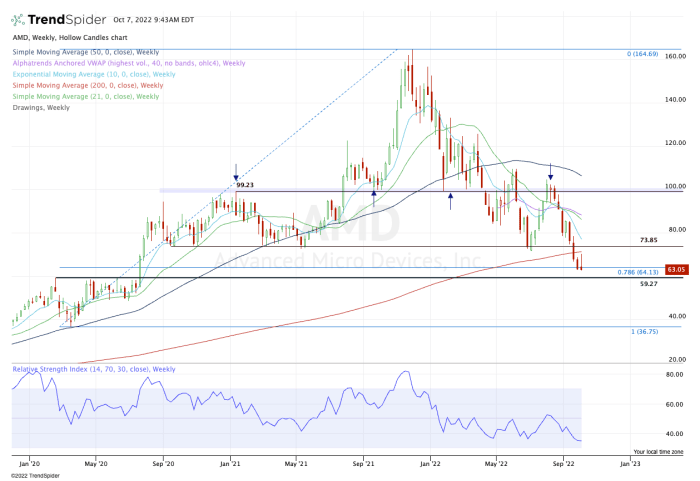

- AMD Stock Is Hitting Lows. Here's When to Buy. - TheStreet

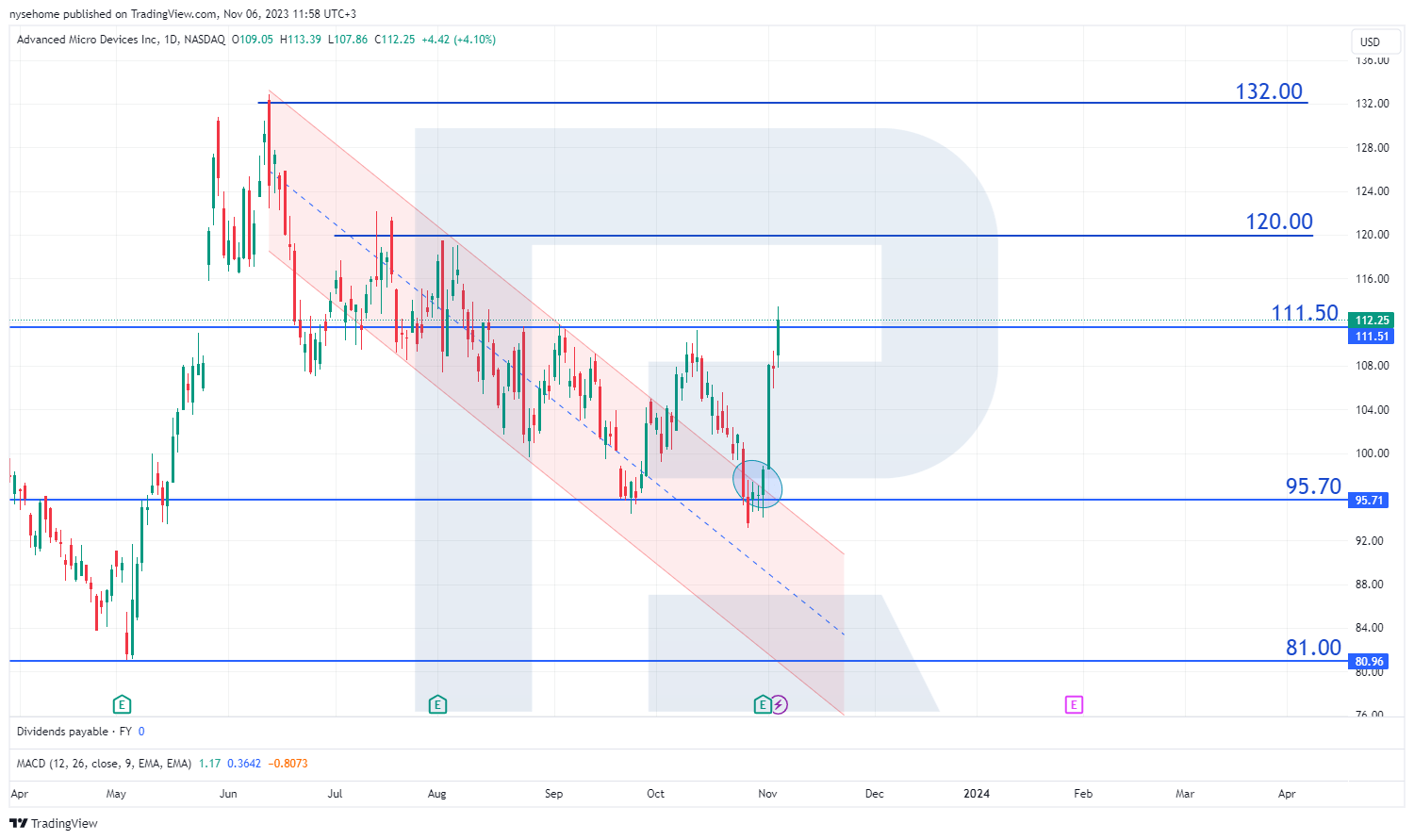

- Advanced Micro Devices is at a significant turning point

- Advanced Micro Devices Inc - AMD Stock Chart Technical Analysis for 11 ...

- AMD Stock: Advanced Micro Devices Doesn't Get the Respect It Deserves ...

- AMD (1969): empresa estadounidense de tecnología – VozBol

- AMD Stock - Advanced Micro Devices Stock Analysis - YouTube

- AMD spikes 4% after earnings and revenue beat (AMD) | Markets Insider

- AMD Stock: Here’s Where You Should Buy Advanced Micro Devices ...

- AMD Stock: Will AMD Stock Price Regain 0 Mark After Earnings?: Guest ...

Advanced Micro Devices, Inc. (NASDAQ:AMD) has been a major player in the semiconductor industry, and its stock price has been a subject of interest for investors and tech enthusiasts alike. In this article, we will delve into the AMD stock price quote, its historical performance, and the factors that influence its value. We will also explore the insights provided by Morningstar, a leading provider of investment research and analysis.

Current AMD Stock Price Quote

As of the latest update, the AMD stock price quote on NASDAQ is around $90.00 per share. The stock has experienced significant fluctuations in recent years, with a 52-week high of $120.00 and a 52-week low of $50.00. The current market capitalization of AMD is approximately $100 billion, making it one of the largest semiconductor companies in the world.

Historical Performance

AMD's stock price has been on a rollercoaster ride over the past few years. In 2018, the stock surged to an all-time high of $34.14, driven by the company's strong performance in the graphics processing unit (GPU) market. However, the stock price declined in 2019 due to increased competition from NVIDIA and Intel. In 2020, AMD's stock price rebounded, driven by the company's growing presence in the central processing unit (CPU) market and its partnerships with major technology companies.

Morningstar Analysis

Morningstar provides a comprehensive analysis of AMD's stock price and financial performance. According to Morningstar, AMD's stock has a 4-star rating, indicating a moderate level of risk and potential for long-term growth. The analyst firm notes that AMD's strong position in the GPU market, combined with its growing presence in the CPU market, makes it an attractive investment opportunity. However, Morningstar also warns that the company faces significant competition from NVIDIA and Intel, which could impact its future growth prospects.

Factors Influencing AMD Stock Price

Several factors influence AMD's stock price, including:

- Competition: The semiconductor industry is highly competitive, and AMD faces significant competition from NVIDIA and Intel.

- Product Innovation: AMD's ability to innovate and release new products that meet the evolving needs of its customers is crucial to its success.

- Partnerships and Collaborations: AMD's partnerships with major technology companies, such as Microsoft and Google, can drive growth and increase its market share.

- Global Economic Trends: Global economic trends, such as trade tensions and recession fears, can impact AMD's stock price and financial performance.

In conclusion, AMD's stock price quote on NASDAQ:AMD is subject to various factors, including competition, product innovation, partnerships, and global economic trends. While the company faces significant challenges, its strong position in the GPU market and growing presence in the CPU market make it an attractive investment opportunity. Morningstar's analysis provides valuable insights into AMD's financial performance and growth prospects, and investors should consider these factors when making investment decisions. As the semiconductor industry continues to evolve, AMD's stock price is likely to remain a subject of interest for investors and tech enthusiasts alike.

Stay up-to-date with the latest AMD stock price quote and news by visiting NASDAQ:AMD and Morningstar. Whether you're a seasoned investor or just starting to explore the world of stocks, it's essential to stay informed and make informed investment decisions.