Table of Contents

- Minimum wage rates increase from 1 April 2024 - Blog : Torgersens ...

- 1st meeting to set 2024 minimum wage falls apart

- The minimum wage is increasing in more than 20 states in 2024 | CNN ...

- April 2024: New Central Minimum Wage Rates Announced

- New Minimum Wage Rates To Be Effective From Oct 1, 2024: Know Details

- Minimum Wage 2024 Mauritius Calculator - Randa Carolyne

- New Minimum Wage Rates effective from 1 April 2024 | Jackson Stephen

- Wage rates and allowances increasing from 1 July 2024 | NatRoad

- Minimum Wage Increase - July 1, 2024

- National Minimum Wage Increase – From 1st April 2024 - Kitson Boyce ...

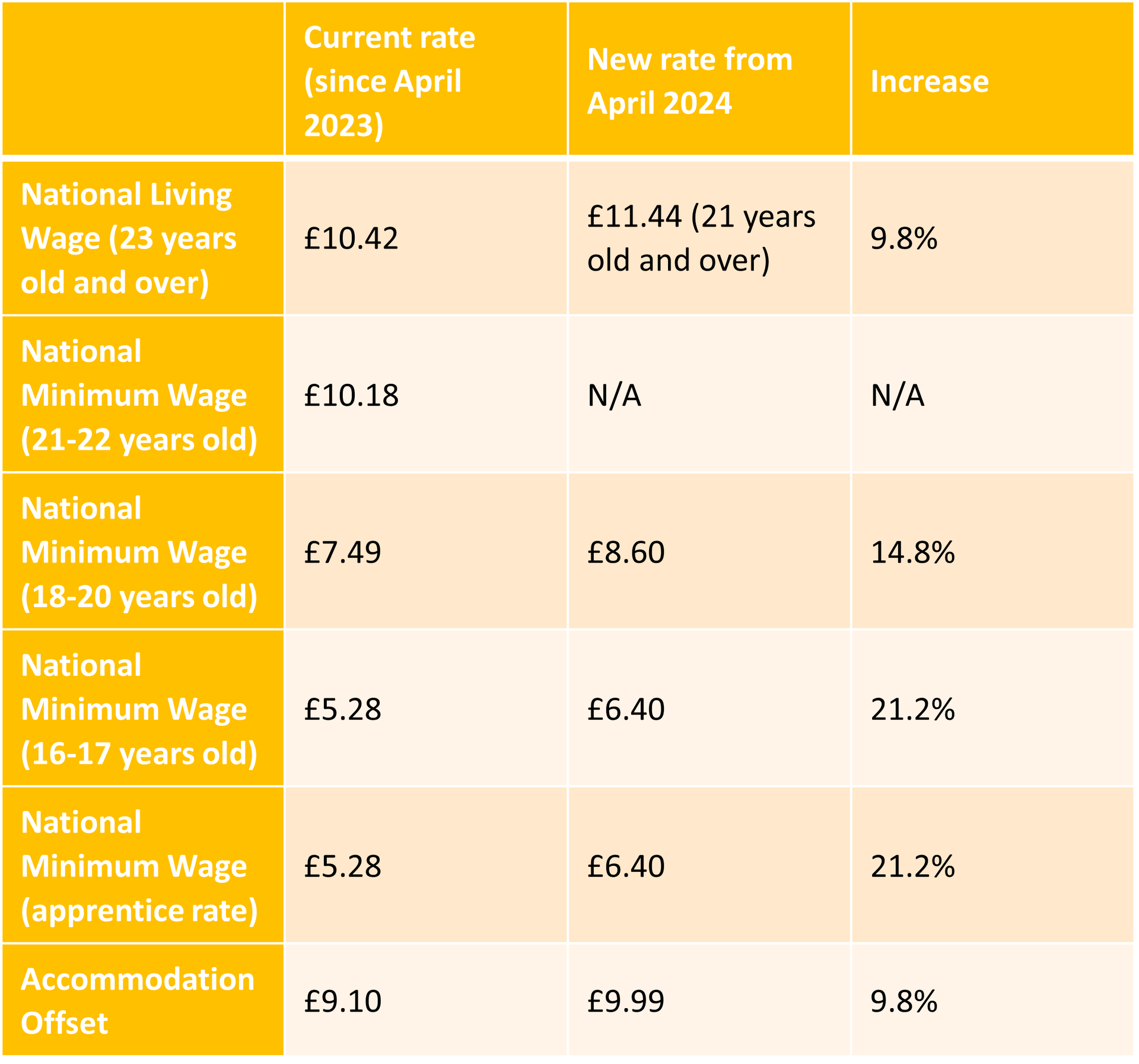

Understanding the Minimum Wage Changes

Key States and Cities Affected

- California: $15.50 per hour for employers with 26 or more employees

- New York: $15.00 per hour for most employees

- Illinois: $14.25 per hour for employers with 4 or more employees

- Massachusetts: $16.65 per hour for most employees

- Seattle, WA: $18.69 per hour for large employers

Implications for Employers

The minimum wage changes will have significant implications for employers, including:- Increased payroll costs: Employers will need to adjust their budgets to accommodate the higher minimum wage rates.

- Compliance requirements: Employers must ensure that they are complying with the new minimum wage laws, including posting updated notices and maintaining accurate records.

- Employee benefits: Employers may need to review and adjust their employee benefits packages to ensure that they are providing fair and competitive compensation.

Preparing for the Changes

To prepare for the minimum wage changes, employers should:- Review their current payroll practices and budgets

- Update their employee handbooks and policies

- Provide training to HR staff and managers on the new minimum wage laws

- Communicate the changes to employees and ensure that they understand their rights and benefits

Stay ahead of the curve and ensure that your business is ready for the minimum wage changes. Contact us today to learn more about how we can help you navigate these updates and maintain a successful and compliant business.